As a new imaging examination technology developed in the 1980s, magnetic resonance imaging (MRI) is another major advancement in the imaging industry after CT, which is known as the crown jewel of modern medical imaging technology. It is the battlefield where many domestic and foreign medical apparatus manufacturers focus on. After years of development, domestic MRI equipment manufacturers continue to accelerate market layout and advance core technology breakthroughs which gradually break the traditional GPS monopoly market. The breakthrough achieved is counted on the most representing cutting-edge technology in the field of 3.0T superconducting MRI systems by domestic manufacturer Basda Medical, which obtained the second 3.0T MRI certificate MRI in China. With the continuous penetration of emerging technologies in MRI, as well as the gradual rise of hierarchical diagnosis and treatment, and third-party independent medical imaging centers, China's MRI market space is expected to continue to expand.

In order to fully understand the market development of China's MRI equipment market and evaluate the prospects and development potential of the MRI market, we have conducted a comprehensive survey and analysis of the China MRI market and its main participants, and has output the "2021 China Medical MRI Market Research Report", with a view to providing insights into China's MRI market.

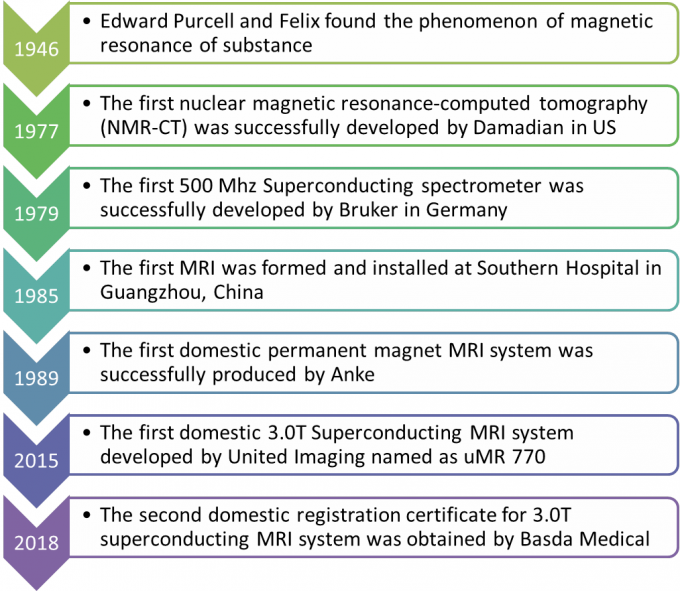

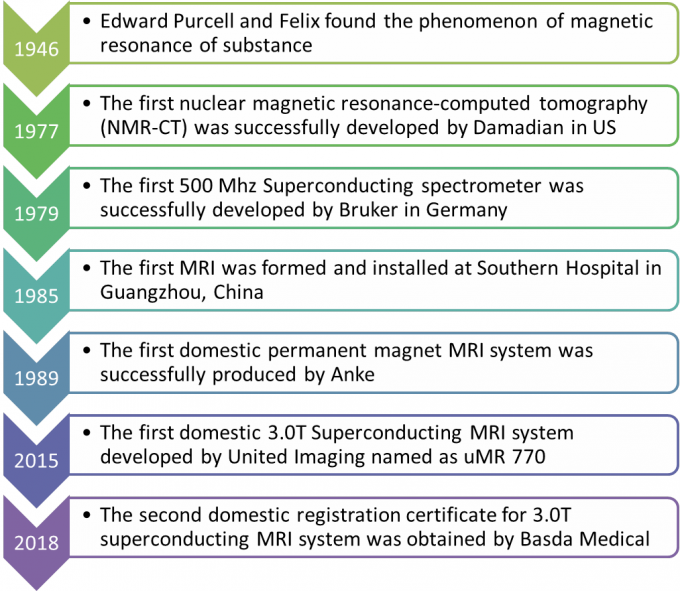

1. The industrial development history of MRI in China

From independent research and development to high-end breakthroughs, China's MRI has gradually moved to the center of the stage. Since the 1980s, MRI technology has been developed at an extremely rapid rate, which has greatly promoted the rapid development of medicine, neurophysiology and cognitive neuroscience. Compared with foreign countries, China's medical MRI industry started relatively late. In 1982, the former State Science and Technology Commission began to organize research projects on MRI technology development, which opened a new chapter in the development of China's MRI industry. In the past 10 years, China's MRI equipment technology has developed rapidly. In 2011, China's first superconducting MRI (1.5T) imaging system with independent intellectual property rights was born. So far, there are two domestic brands, Shenzhen Basda Medical and United Imaging have obtained the CFDA registration certificate for 3.0T superconducting MRI system which symbolize that China’s domestic high-end MRI has begun to emerge.

2. China's MRI market value and industry development status

Driven by favorable policies such as the national support for import substitution of domestic MRI equipment, the gradual relaxation of management in the area of large-scale medical equipment n, the acceleration of medical infrastructure, and the construction of third-party medical imaging diagnosis centers, China's MRI terminal market will continue to expand with great potential development.

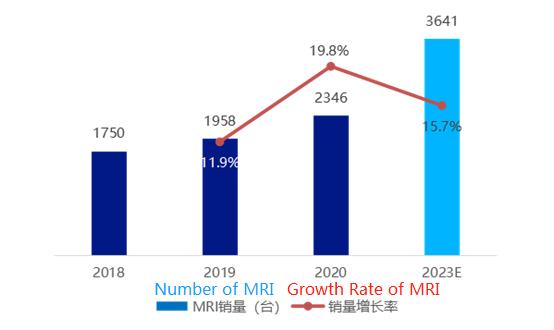

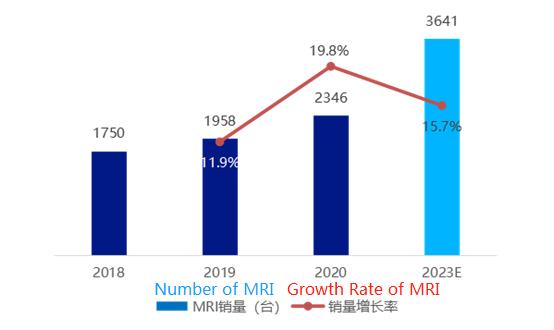

In 2023, the number of MRI equipment sold in China will exceed 3,600 units which showcases the demand in China's MRI market is strong. According to statistics, the annual sales of MRI equipment in China increased from 1,750 units in 2018 to 2,346 units in 2020, and the growth rate increased from 11.9% in 2019 to 19.8% in 2020. Taking into account the continuous increase in the number of hospitals in China and the demand for MRI for equipment replacement, the state has increased investment in informatization construction of primary medical institutions, and the practice of hierarchical diagnosis and treatment is driven by various factors. As a result, it is expected that the sales of MRI equipment in China will increase in the next three years with a growth rate of 15% which leads to the number of MRI machines in China to reach 3,641 units by 2023.

Sales Volume of MRI system from 2018 to 2023 in China

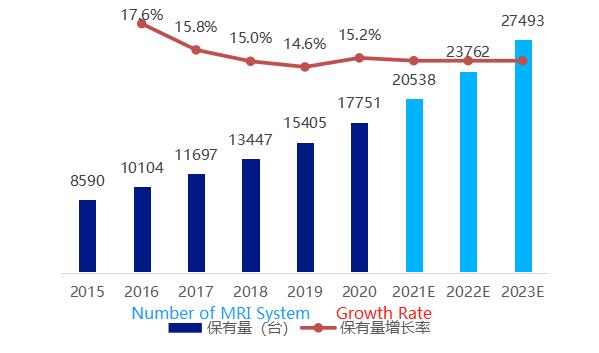

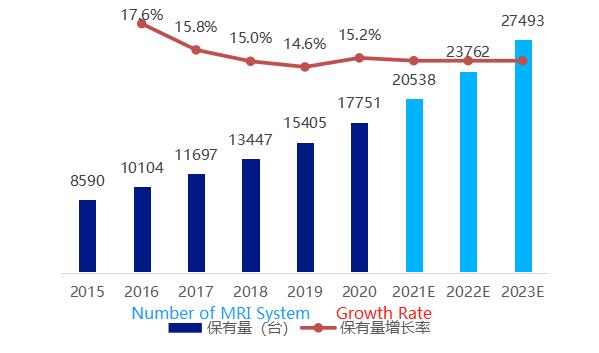

The MRI market shows a rapid growth, and the CAGR will remain at 15%. The market share of MRI equipment in China has maintained a rapid growth trend in recent years. From 2015 to 2020, the compound growth rate (CAGR) of China's MRI equipment share is 15.6%. Among them, the MRI market has 17,751 units in 2020 with an annual growth rate of 15.2%. With the continuous development of health services and medical technology in recent years, the adoption of new technologies, and the development of MRI equipment itself, a large number of old products have been retired, which has prompted the rapid growth of the market demand for MRI equipment. It is predicted that the average annual growth rate of MRI equipment in China will remain at around 15% in the next three years, and the number of MRI equipment in China will reach 27,493 units by 2023.

Number of MRI system from 2015 to 2023 in China

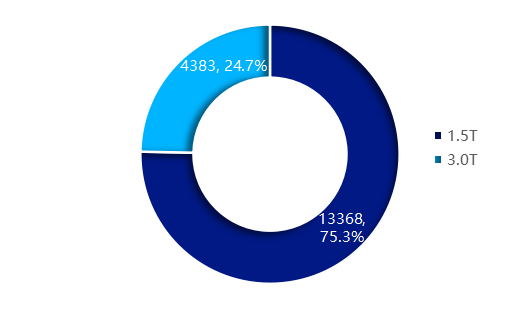

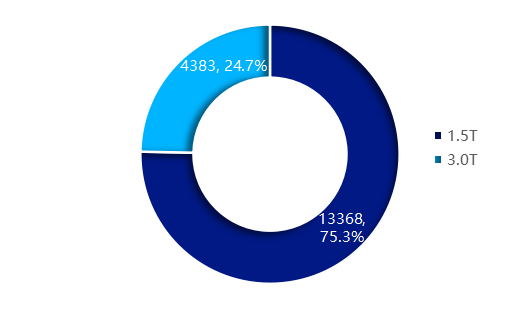

The penetration rate of 1.5T MRI products is relatively high, accounting for more than 75% of the MRI market, which also creates a large space for domestic alternatives. In terms of the MRI product classification, the domestic MRI stock market is mainly dominated by 1.5T and 3.0T models. Moreover, the market share of 1.5T MRI is much higher than that of 3.0T MRI because it can meet the basic clinical needs. The data shows that in 2020, the number of 1.5T MRI equipment in China is 13,368, accounting for 75.3%; the number of 3.0T MRI equipment is 4,383 due to high product prices and government approval, accounting for 24.7% of the total number of MRI machines. At present, domestic MRI equipment market is still dominated by 1.5T, where there is a large space for domestic alternatives.

Number of MRI Machines in China in 2020

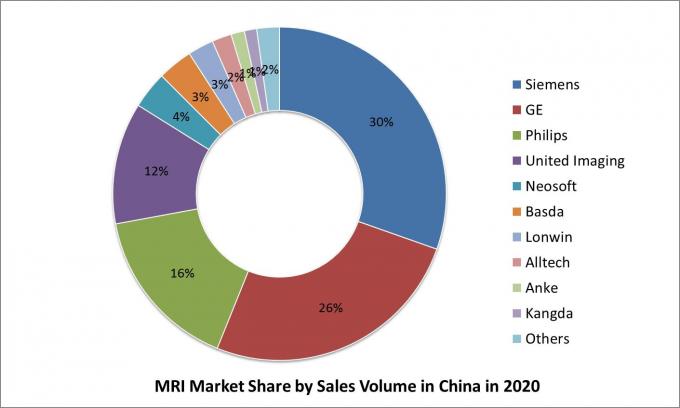

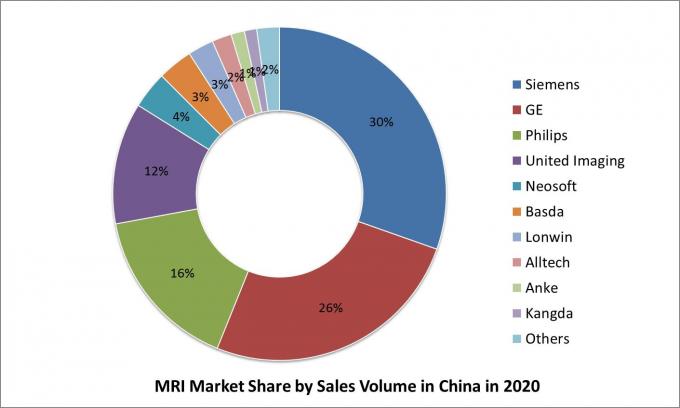

The MRI market is highly concentrated while the market share of China’s domestic brands continues to increase.

The market share of domestic brands continues to increase. Specifically, United Imaging, Neusoft and Basda are among the top 5 in the MRI sales market. In 2020, the top 5 companies in China's MRI equipment market by sales are Siemens, GE, Philips, United Imaging and Neusoft, with a high market concentration accounting for about 87.5% of all sales. Among them, the sales of the three foreign-owned brand GPS accounted for 72.1%, while the domestic brand market share was 27.9%.

3. Assessment Potential of China MRI Market and Future Development Trend Forecast

(1) Potential Value Scale

In 2023, the value of China's MRI market will exceed 25 billion RMB. Statistics show that in 2020, the sales of China's MRI market will reach 15.6 billion RMB, a year-on-year increase of 18.2%. To consider that the average annual growth rate of China's MRI equipment inventory and sales in the next three years as a whole, the annual growth rate of China's MRI equipment will remain at around 15%. The average price of MRI is expected to be about 7.1 million RMB (taking inflation into account), and the market value of China's MRI equipment will reach 25.8 billion RMB while the market prospect is promising.

(2) Trends of MRI Product and Technology is obviously binomial: miniaturization and portability will become one of the focuses in R&D

At present, MRI products and technological innovations are developing in two directions. On the one hand, the low magnetic strength (low-field MRI technology) product will develop in three directions: accurate measurement of weak signals, quick response to magnetic signals, and acquisition of more information of MRI equipment. On the one hand, superconducting MRI products are moving towards higher field strength. At present, due to the disadvantages of larger size and high price of high-field MRI equipment, the features of low-field, smaller magnet material, portable, low-cost, personalized and even handheld have become the future development trend of MRI technology. In 2020, FDA approved the world's first mobile magnetic resonance imaging (MRI) imaging device for use in head applications in patients over two years of age. Compared with large-scale MRI, the unit price is about 50,000 US dollars, while the cost of a single examination is reduced by 20 times. Furthermore, the power consumption is reduced by 35 times. Compared with high-field MRI equipment, it is more cost-effective and convenient.

High-end superconducting magnetic resonance (MRI) equipment is expected to accelerate the domestic import substitution.

State-owned brands have begun to make efforts in the R&D, design, and manufacturing of key core components such as ultra-high-field superconducting magnets. By doing this, the domestic products gradually break the monopoly of multinational companies on ultra-high-field superconducting magnet technology. Taking 3.0T superconducting MRI equipment as an example, two domestic superconducting magnetic resonance (MRI) manufacturers, United Imaging and Basda, have obtained the CFDA registration certificate, and each has 3 models and 1 model of 3.0T Magnetic Resonance (MRI) equipment. Among them, China's first 3.0T human magnetic resonance (MRI) system developed by United Imaging has achieved large-scale industrialization and has entered clinical applications in nearly 100 government owned hospitals. In addition, China continues to increase the import substitution policy for large medical equipment. As of September 2020, the China Medical Equipment Association has released a total of six batches of excellent domestic medical equipment product catalogs, and a total of 10 companies' superconducting magnetic resonance equipment products have been selected. In the future, there will be a pattern of domestic and foreign companies competing on the same stage in the high-end superconducting magnetic resonance (MRI) market.

Source: China Health Research Institute

China.com.cn/MedicalHealthChannel

Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!  Your message must be between 20-3,000 characters!

Your message must be between 20-3,000 characters! Please check your E-mail!

Please check your E-mail!